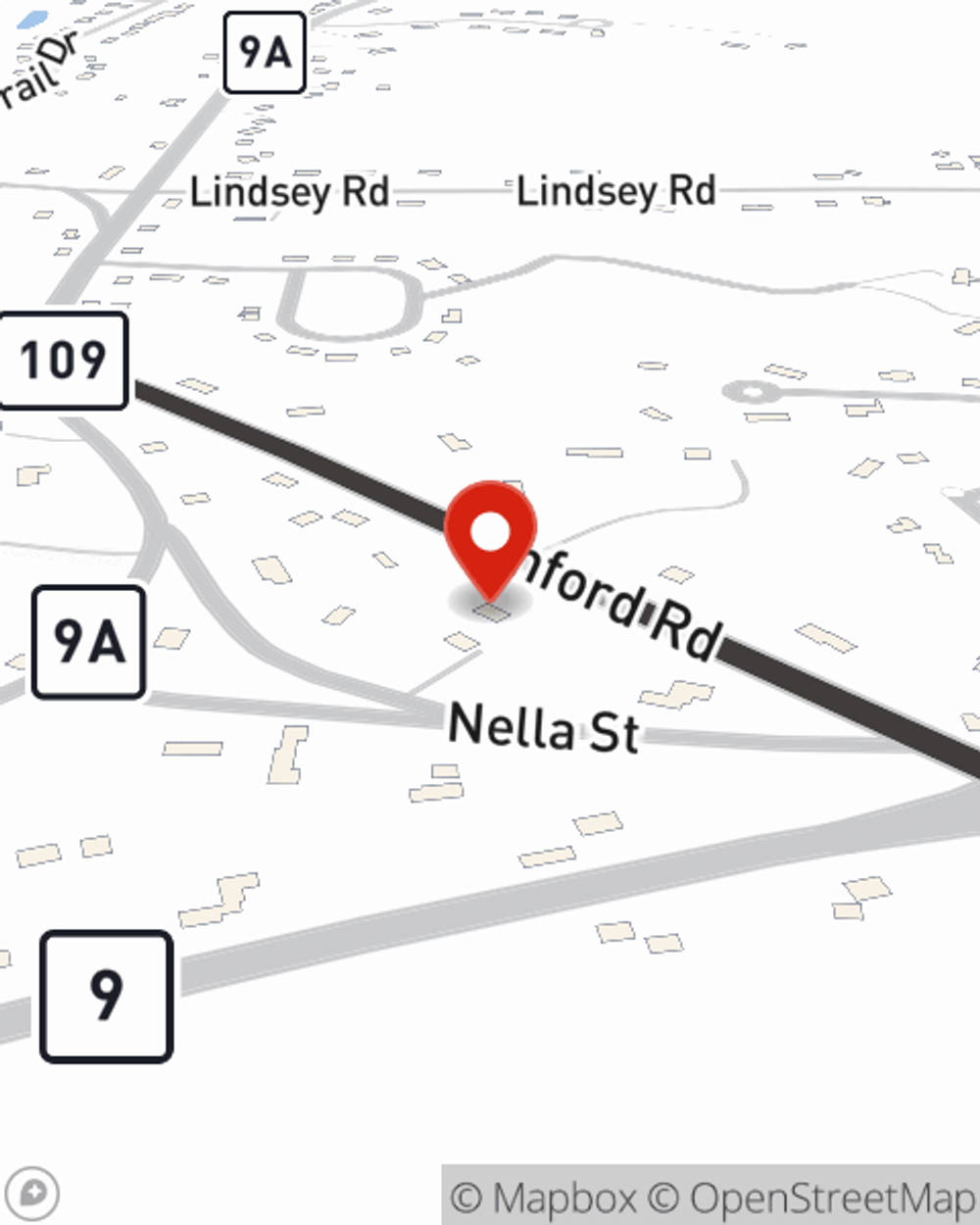

Business Insurance in and around Wells

Looking for small business insurance coverage?

Helping insure businesses can be the neighborly thing to do

- Wells

- 04054

- 03907

- 03906

- 03908

- 03901

- 04073

Help Prepare Your Business For The Unexpected.

Running a small business comes with a unique set of challenges. You shouldn't have to wrestle with those alone. Aside from just your loved ones, let State Farm be part of your line of support through insurance options including business continuity plans, a surety or fidelity bond and errors and omissions liability, among others.

Looking for small business insurance coverage?

Helping insure businesses can be the neighborly thing to do

Protect Your Business With State Farm

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance coverage by small business owners like you. You can work with State Farm agent Nancy Hafford for a policy that protects your business. Your coverage can include everything from worker's compensation for your employees or business continuity plans to mobile property insurance or group life insurance if there are 5 or more employees.

Call Nancy Hafford today, and let's get down to business.

Simple Insights®

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

Nancy Hafford

State Farm® Insurance AgentSimple Insights®

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.